Are you ready to change how your food is served? Here are four fabulous tips…

Nobody in Foodservice and E&S is Gouging Anybody with Prices

April 15, 2022 from the Robin Ashton Report

News, Data, Analysis and Commentary from Robin Ashton

I’m starting to hear some rumblings I don’t like at all. And I’m going to do my best to put a stop to it right now. There is some talk down the E&S channels, all the way to buyers, that manufacturers are using the present situation to raise prices as fast and as much as they can to boost their profits. That, in other words, producers and suppliers are gouging those downstream.

Please, don’t accuse people of gouging. It is, to the best of my knowledge—and I talk to a lot of people, who are kind enough to privately share hard margin info—NOT true. Oh, there’s always an outlier, but that’s why they are called outliers. Anyone can tell who those folks are. One always has the power of the purse against them.

This kind of loose “gouging” talk is not good for the market in any way. No one’s an exclusive victim of this environment. We’re all victims, so suck it up and deal with it. Prices are rising and are going to continue to rise. Everyone in the chain—from OEM manufacturer, wherever they may be, to ultimate operator buyer—has to make money to stay in business. As the details from the monthly Producer and Consumer Prices Indexes below make clear, prices for everything are rising dramatically.

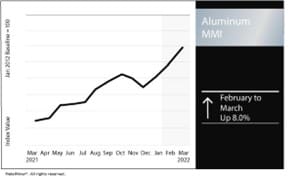

But they have been, ever since we began to emerge from the worst of the covid pandemic in March and April 2021, thanks to remarkable vaccines. If you’ve paid any attention to this newsletter, you know prices for materials used in E&S from industrial metals to plastics have doubled, tripled or even quadrupled—raw steels!—during the past 18 months. Key components are hard to get and thus very expensive to source. Commodities traders try to anticipate prices changes; they saw the bounce-back in demand coming and knew there was no longer sufficient production capacity and lots of uncertainty. They feed on uncertainty. Don’t tell me you didn’t see that things got so crazy, the London Metals Exchange had to shut down trading in nickel last month. The first time—EVER—that the LME shut down trading in one of its core commodities. I’ve been screaming it! You can see the result in the NAS stainless steel surcharge item below: 47%!

Then there are all the logistics and supply-chain dislocations. I’ve also written endlessly about those. Friends tell me, and I’ve reported the hard data, that in some cases, the price of shipping a 40-ft. container of stuff from China to the US has risen five times.

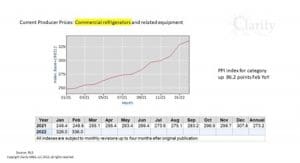

No supplier can eat all that and remain in business. So, when you see how much E&S prices—which we’ve reported every single month since last fall (thanks to Mike Posternak)—have risen again, don’t freak out. We already have three major categories—refrigeration, cooking and warming, and wire shelving and utensils—with annual price increases north of 25% to 35% as of February. Everything is up double digits. But when your materials costs double or triple and your transportation costs rise four or five times, those increases don’t even keep you even. Come on, you folks can all do simple math.

You’ll see the latest E&S PPI price changes again next week, after my forecasting and research partner John Muldowney of Clarity M&A has a chance to pull them. They will not be pretty, I know. Heck, as you can see below, prices for everything else in the PPI are up. Everything.

And, I’m sorry. Prices are not going to moderate anytime soon. The supply chains are still kinky—actually getting worse again—and E&S manufacturers are now facing some of the largest materials-price changes they have experienced, at least since the 1970s. Which means many of today’s E&S execs were babies, if even born yet. Not me. As I wrote a couple weeks ago, I’ve been there and seen worse.

Everyone in this system should be doing the best they can to help one another deal with these prices. And many are. But some are looking for someone to blame for reasons that elude me. Well, not really. It’s always hard to tell your channel partner or your customer the hard truth. Salespeople hate those conversations. I’ve been there, when I’ve had to tell major customers we were raising ad rates 5% because of printing, paper and postage cost increases. It’s always easier to deflect the pain of the customer response and blame someone upstream. Heck, it’s Sales 101.

And I have particular empathy for folks such as bid dealers and those with major chain customers. They are used to a world where they could negotiate a price and expect—no, demand—the manufacturer honor it. That world is gone and some are whining about it. I feel bad. But no one can eat these levels of increases. And everyone should be helping the ultimate customers—the operators who write the checks or send the ACHs that pay for everything—understand and deal with the realities of what these products now cost to make and deliver. As I used to tell my salespeople, those hard conversations are the reason you get paid the big bucks. Just be honest. The customer usually gets it. If they don’t, get a new customer because you can’t make money on that one.

We have hard realities in the market right now with both prices and lead times. I understand it gets tiring, as it’s been going on for more than a year. But take out your frustrations in some other, more productive way. Go take up kick boxing, taekwondo or something. Hit a golf ball. We are all in this together. Please.

OK. I said my piece.